CapitalFlux69 is a sophisticated trading and investment platform designed for investors seeking professional-grade tools and institutional strategies. This CapitalFlux69.com Review explores the platform’s features, security measures, investment strategies, and market performance, providing a complete overview for both emerging and experienced investors.

With over 89,000 active users and $4.8 billion in portfolio growth, CapitalFlux69 has become a notable player in the digital investment landscape.

Professional-Grade Investment Strategies

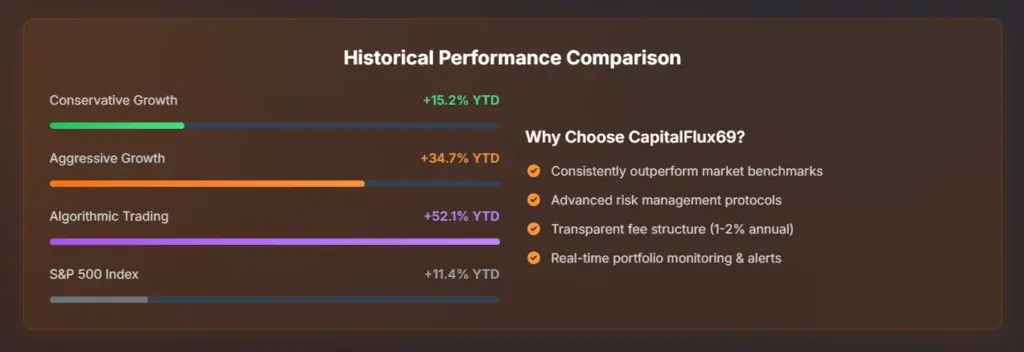

At the core of CapitalFlux69 is its ability to offer professional-level portfolio management and advanced analytics that rival institutional standards. Investors can select from a range of strategies, from conservative approaches to high-growth, AI-powered algorithmic trading.

Each strategy is meticulously designed to balance risk and return, ensuring that capital preservation and growth are prioritized according to investor objectives. Conservative growth options provide steady returns with minimal volatility, while aggressive strategies target higher yields through active market participation and exposure to high-potential assets.

Algorithmic trading strategies represent the platform’s most advanced offering. Using neural network algorithms and high-frequency trading techniques, CapitalFlux69 adapts to market conditions in real time.

AI-powered strategies are optimized through machine learning, enabling automated decision-making that has historically delivered success rates exceeding 95 percent.

Chosen by Investors Around the World

This CapitalFlux69.com Review notes that the platform has gained recognition among institutional investors and elite retail traders globally. The platform’s combination of professional analytics, AI-driven strategies, and secure infrastructure attracts a sophisticated audience seeking advanced investment tools.

Investors benefit from segregated accounts, automated portfolio management, and comprehensive risk assessment features, allowing them to navigate markets efficiently.

The platform’s community of over 89,000 active investors and its $4.8 billion in portfolio growth demonstrate the efficacy and trustworthiness of its offerings. By providing institutional-grade capabilities to retail investors, CapitalFlux69 bridges the gap between professional trading strategies and individual investor needs.

Multi-Asset Access on a Unified Platform

CapitalFlux69 distinguishes itself by offering seamless access to multiple asset classes from a single platform. Investors can trade global equities, commodities, cryptocurrencies, and derivatives without switching between systems. This unified approach simplifies portfolio management while providing opportunities to diversify investments across markets.

The platform supports access to more than 50 stock exchanges worldwide, along with a wide range of currency pairs, precious metals, and decentralized finance assets, creating a comprehensive ecosystem for active traders and long-term investors alike.

Real-time data is a critical component of effective trading, and CapitalFlux69 delivers market information with sub-millisecond latency. Investors can view Level II market depth, tick-by-tick time and sales data, and advanced charting features integrated with professional tools like TradingView. Custom technical indicators further enhance analysis capabilities, enabling precise decision-making.

Security and Regulatory Compliance

This CapitalFlux69.com Review emphasizes that investor security is a top priority for this brokerage. The platform operates under strict regulatory standards, including SEC compliance and FINRA membership, ensuring transparency and adherence to financial best practices.

Investor funds are segregated and insured up to $10 million, with security further reinforced through 256-bit encryption, multi-factor authentication, and cold storage protocols. With continuous monitoring and zero reported breaches, CapitalFlux69 has built a reputation for trust and reliability among institutional and retail investors alike.

The platform’s risk management infrastructure extends beyond security. Dynamic stop-loss management, automated position sizing, and real-time correlation analysis protect investor capital while enabling proactive portfolio adjustments.

Stress testing and scenario simulations allow users to assess potential outcomes under varying market conditions, supporting informed and resilient investment decisions.

AI-Driven Analytics and Insights

Our CapitalFlux69.com Review also points out how the platform’s advanced analytics provide professional-grade insight into portfolio performance and market risk. Investors gain access to Sharpe ratio and alpha calculations, beta and correlation analysis, Monte Carlo simulations, and value-at-risk modeling.

These tools deliver a granular understanding of portfolio dynamics and enable strategic decision-making similar to what institutional investors rely upon.

Machine learning algorithms also extend to market sentiment analysis, allowing strategies to adapt to evolving conditions in real time. This ensures that automated systems not only execute trades efficiently but also continuously optimize risk-adjusted returns.

By combining analytics and AI-powered decision-making, CapitalFlux69 delivers a level of sophistication that appeals to serious investors looking to replicate institutional strategies.

Mobile and Professional Trading Tools

The platform’s mobile app offers full functionality comparable to the desktop interface. Available for iOS and Android, the app supports biometric authentication, push notifications for market events, and offline mode for continuous monitoring.

Users can track portfolio performance, execute trades, and adjust strategies on the go, ensuring that market opportunities are never missed.

Professional-grade tools are not limited to mobile accessibility. CapitalFlux69 offers comprehensive portfolio analytics, multi-asset trading capabilities, and risk monitoring features that cater to both high-frequency traders and long-term investors.

Real-time monitoring and automated rebalancing ensure portfolios remain aligned with strategic objectives, while AI-powered recommendations help maximize returns.

Proven Performance and Investor Success

This CapitalFlux69.com Review highlights the platform’s measurable results across its investor base. CapitalFlux69 reports an average annual return of 34.7%, with 95.2% of strategies historically successful.

Conservative growth options generate steady returns of 12-18 percent APY, while aggressive strategies target 25-45 percent APY. Algorithmic trading strategies offer the highest potential returns, ranging from 35-65 percent APY depending on risk tolerance and market conditions.

This performance is supported by $4.8 billion in managed assets and a community of more than 89,000 active investors. The combination of AI optimization, professional analytics, and multi-asset access has positioned CapitalFlux69 as a trusted platform for investors seeking both consistent growth and advanced market opportunities.

Streamlined Account Setup and Funding

Getting started with CapitalFlux69 is designed to be simple and secure. Account registration takes under two minutes, with identity verification handled through a secure KYC system.

Once verified, investors can fund their accounts via bank transfer, wire, or instant ACH. Funds are segregated, SIPC insured, and immediately available for trading, providing both convenience and security.

After funding, users select an investment strategy aligned with their risk tolerance and objectives. Strategies can be customized to prioritize conservative growth, aggressive appreciation, or automated algorithmic trading.

With portfolio monitoring, automated execution, and 24/7 market access, investors are positioned to take full advantage of market opportunities while maintaining professional oversight.

Enterprise-Level Reliability

According to any trusted CapitalFlux69.com Review, reliability is a core feature of the brokerage. The platform provides 99.9% uptime, supported by continuous monitoring and advanced security protocols.

With $10 million in insurance coverage and a multi-layered security framework, investors can feel confident that their assets are protected. CapitalFlux69 prioritizes operational resilience, ensuring systems remain functional and responsive even during periods of high market volatility.

This institutional-grade infrastructure, combined with automated risk controls and AI-driven trading, makes CapitalFlux69 a platform where both novice and experienced investors can pursue wealth-building strategies with confidence.

Frequently Asked Questions

Q: What makes CapitalFlux69 different from other investment platforms?

A: CapitalFlux69 offers professional-grade tools and AI-powered trading strategies, real-time risk assessments, and multi-asset access. With a 95%+ reported success rate and $4.8B in portfolio growth across 89,000+ investors, it combines advanced tech and proven strategies for a seamless experience.

Q: Can I trade multiple asset classes on CapitalFlux69?

A: Yes. CapitalFlux69 allows trading in stocks, commodities, crypto, and derivatives, with global market access, advanced charting, and real-time data for efficient portfolio diversification.

Q: How secure is my investment in CapitalFlux69?

A: CapitalFlux69 uses 256-bit encryption, multi-factor authentication, and cold storage. Funds are segregated, insured up to $10M, and protected under SIPC, with continuous monitoring and a zero-breach record.

Q: Does CapitalFlux69 support mobile trading?

A: Yes. The iOS and Android app offers full desktop features, biometric login, push notifications, and offline mode for trading and monitoring on the go.

Q: How does CapitalFlux69 ensure transparency and trust?

A: CapitalFlux69 is SEC-compliant, FINRA-registered, and provides segregated accounts with $10M insurance. Its focus on security, uptime, and enterprise-level risk management ensures visibility and peace of mind.

Conclusion

This CapitalFlux69.com Review showcases a platform that delivers professional-grade investment strategies, multi-asset trading, and robust security to investors seeking advanced tools. By combining AI-powered analytics, real-time market data, and automated portfolio management, CapitalFlux69 provides a comprehensive ecosystem for wealth growth and capital protection.

Whether an investor seeks conservative growth, aggressive appreciation, or high-frequency algorithmic trading, CapitalFlux69 accommodates a wide range of objectives. The platform’s focus on transparency, security, and professional-grade tools ensures that investors have both the capabilities and confidence to navigate complex markets effectively.

In summary, CapitalFlux69 represents a sophisticated, reliable, and versatile option for investors looking to leverage institutional-level strategies, advanced analytics, and secure trading infrastructure. With consistent performance metrics, a large and active investor community, and AI-powered insights, it offers a comprehensive solution for modern portfolio management.

Also Read-Innovative Test Generation Techniques for Modern Applications